Overseas Filipino workers (OFWs) will soon have the opportunity to invest in their government’s retail dollar bonds, with plans to offer these bonds to overseas investors, including UAE-based OFWs, by the end of this month, according to Rosalia de Leon, the country’s National Treasurer.

This initiative is part of the government’s strategy to raise $2 billion through the retail bond issue.

Rosalia de Leon explained, “As for our financing for this year, we will issue the second leg of government-issued retail dollar bonds. We have been issuing fixed-income peso bonds, but this time, we are catering to overseas Filipinos.”

These retail bonds will be accessible to OFWs, who can purchase them using e-wallets.

Responding to a question from TFT, de Leon emphasized that the initiative will exempt OFWs from up to 20% in taxes that a regular investor would typically bear.

Read: Philippine Economic team encourages Middle East entrepreneurs to invest in infrastructure and energy

Finance Secretary Benjamin Diokno highlighted the potential benefits, stating, “The retail bonds are a good investment for UAE-based Filipinos looking to save for their kids’ education, for example. The investments would be used to build the country’s infrastructure.”

The announcement was made during a high-level delegation’s visit from the Philippines to Dubai as part of their global investor roadshow, ‘The 2023 Philippine Economic Briefing,’ held on September 12.

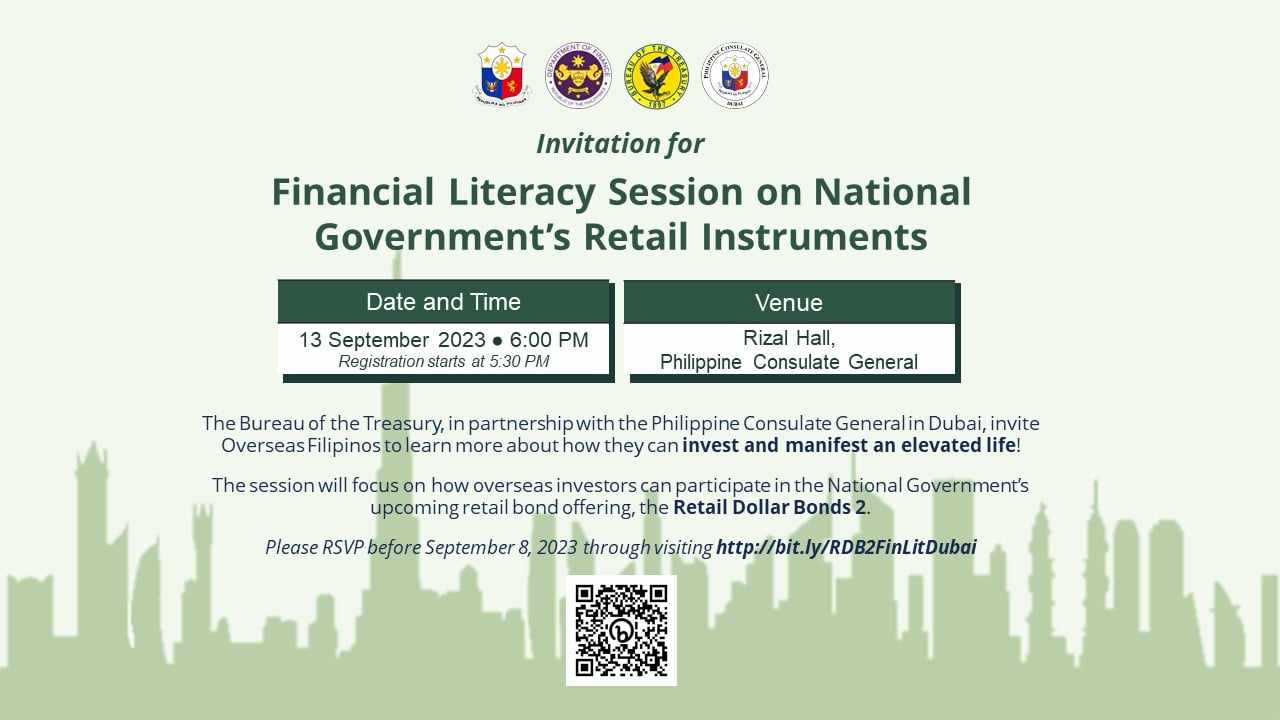

A comprehensive exploration of this initiative will take place during the Financial Literacy Session about the National Government’s Retail Instruments at the Philippine Consulate General on Wednesday.

National Economic and Development Authority Secretary Arsenio Balisacan urged UAE investors to consider participating in the 194 infrastructure flagship projects planned by the Philippine government.

Over 30% of these projects will be funded either fully or partially through public-private partnerships, as outlined by Balisacan.

Retail dollar bonds are an essential component of the government’s strategy to make government securities more accessible to retail investors, particularly individuals. These bonds are offered in five- and ten-year tenures, with interest rates set at 1.375% for the five-year bonds and 2.25% for the ten-year bonds.

OFWs to access dollar retail bonds as Philippines eyes 2024 launch of Islamic bonds

Source: Pinoy News Udpates PH

0 comments :

Post a Comment