The exchange rate between the Dollar and the Peso is at an all time high, averaging at Php 59 to $1. As of publishing time, this rate extends to the UAE dirham, where OFWs in the UAE can get up to around Php 16 for every AED1 they earn.

It is times like these when OFWs are faced with the question: “Should I save my money, or is it time to invest?” This has since brought forth the now-popular statement of Ilocos Norte Representative and presidential son Sandro Marcos: “The peso is not weak, because the peso is weak. The peso is weak because the dollar is strong.”

Since then, the statement of the lawmaker had been the talk of the town – and while some question its semantics, ordinary Filipinos who feel the sting of the rising prices of daily commodities find themselves thinking: Has the value of the peso really gone low after all these years?

A glaring example of how money’s value changes overtime is the price of a garlic pepper beef dish from a well-loved fast-food chain in the Philippines. Just eight years ago, netizens noted that the price of this dish was only Php49 to Today, you will need Php95 to buy the same.

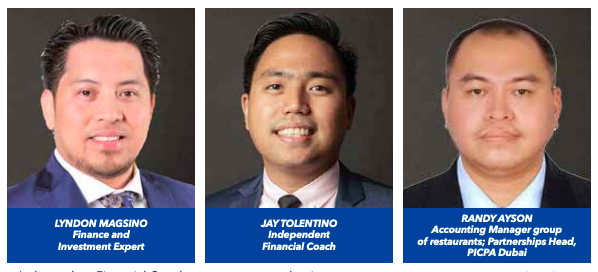

Randy Ayson, a Financial Literacy Advocate and an Accounting Manager of a group of restaurants in Dubai, stated that this reflects the weakness not of the peso – but of the purchasing power of money over a period of time if it’s only saved and kept in banks, instead of invested in assets.

“Time is money. Inflation will reduce your purchasing power. This applies to investment as well,” said Ayson.

Better to invest than just save High exchange rates make it irresistible for OFWs in UAE to send more money – especially since their families back home receive more in peso compared to several months ago when the peso hovered around the Php 15 level.

However, as the inflation rate is likewise high, OFWs should be aware of the fact that the expenditures of their loved ones have likewise increased. And that even if they save the money in the bank, the likelihood of their money having a ‘weaker’ purchasing power – or as Pinoys coin it – ‘lugi’, as time passes by.

Therefore, investing money in an asset becomes one of the dependable options of OFWs – giving their peso remittance an opportunity to grow further beyond its initial value. The Filipino Times speaks to several financial experts in the UAE to find out the facts behind inflation, and how OFWs can discern the difference between investing and saving money.

Independent Financial Coach Jay Tolentino, in an interview with The Filipino Times, shared that the difference between the two can also be distinguished depending on your end goal.

“If the goal is to grow your money long-term and naiintindihan mo yung investment na papasukin mo, then investing is recommended versus saving. Magkaiba kasi ang purpose ng saving and investing. When you say Saving, you’re putting aside money today for future short-term goals tulad ng down payment for your house, buying a car or building your Emergency Funds. When you save, you don’t expect your money to grow that much. Ang Investing naman means buying an asset with the expectation for it to increase its value over time, not overnight. It is good for mid to long-term financial goals like funding your child’s college education, Golden Wedding Anniversary, or retirement,” said Tolentino, who’s also the creator of the podcast “Pera and Purpose”.

Lyndon Magsino, Finance and Investment Expert, explained that explained that one major difference between savings and investments is its associated risks. “Before you invest, you need to be familiar with all of these investment opportunities and assess your risk appetite vs. the risks associated with such investments. Remember the general rule: “the higher the risk, the higher the reward”,” said Magsino.

For his part, Tolentino highlighted the fact that the prices of many assets today are below their usual market value. “With a stronger AED/USD, you can buy more assets that are denominated in PHP and other weaker currencies if you’re investing globally. Most importantly, now is the best time you start investing IF you have already paid all your consumer debts, saved enough money for your Emergency Funds, and bought your Term Life Insurance with Critical Illness and Disability cover,” explained Tolentino.

Building a habit

For his part, Ayson explained that the biggest misconception of Filipinos is that investing is only for wealthy people.

“The biggest misconception of Filipinos when it comes to investing is that investing is for the rich people only. Filipinos do not include investments in their budget because they prioritize wants over their needs. Filipinos prefer instant gratification instead of having clearly defined financial goals, including investments, that they will strive to attain,” said Ayson.

He also emphasized the importance of having a financial goal to help with building the habit to save. “We need to have a clearly defined financial goals and we need to stick with them. Kung kinakailangan, bawasan muna yung Starbucks coffee, iwasan muna ang mag travel kung saan saan, wag munang bumili ng additional pair of shoes para makapagipon sa hinaharap,” Ayson added.

If you haven’t found the reason to save or invest or realized just now that you have been too carefree with spending your hard-earned money, Tolentino encouraged reflecting on your ‘why’ and looking forward to the future. “I would ask them to go back to their ‘why’. Bakit sila nagabroad in the first place? Para kanino ba sila nag-iipon? Kapag kasi clear ang purpose mo, kahit mawalan ka ng trabaho o ano mang pagsubok ang dumaan, pipilitin mong gumawa at humanap ng paraan,” said Tolentino. (Why did they choose to fly abroad in the first place? To save? Once you find a clear purpose, even if you lose your job or regardless of any challenges, you will still make ways.)

After this, you can begin by establishing a habit. And for beginners, it doesn’t even need to be big. If you can’t go against your reflexes to spend, there are now advanced banking options which automatically saves a portion of any incoming amount to your account.

“Kahit mag-start ka with 1 AED lang. What’s important is you build the habit of saving until such time na masanay ka na and lumaki na yung kaya mong i-save every month. Remember, if you can’t manage to save a small amount of money today, paano pa ang malaking investment in the future? One other tip is to automate your savings. You can do this by opening a separate savings account and setup an auto-deduct function from your salary account to your personal savings account. Isipin mo na lang you’re putting a tax that will benefit your future self,” said Tolentino.

Magsino detailed why one must invest and how investing can help a person grow his wealth. “The first-best time to invest was 10 years ago. The second best time is now,” said Magsino, who is also the author of the book ‘PISO Master’. He expounds that investing helps you with:

• Financial security: A diverse investment portfolio increases financial security. More than one source of income, with different risk profiles, helps grow savings at a pace suited to each person.

• Wealth creation: Investing a part of monthly savings in the stocks and bonds markets, for example, may increase wealth at a much faster pace in the long run compared to the returns from a savings account. • Achieving financial goals: Investing is an important step toward meeting financial goals such as buying a house or a car or paying for education.

• Preparing for emergencies: Investing is a great way to grow an emergency fund. Emergencies such as illness and unemployment can render one unable to meet expenses if there is no fund set aside for them.

“As per Warren Buffet, “Be fearful when others are greedy. Be greedy when others are fearful”. The best time to invest is when the market is down. Just wait for the right time for the market to stabilize, then sell your investment at a higher price. The difference between your purchase price and the selling price is your “Gain”,” Magsino added.

Analyzing why despite being known to be hardworking individuals, many Filipinos still have no savings or investments, one strong reason stands out: the wrong expectation of Filipinos that wealth can be amassed instantly which is deeply rooted from the lack of financial literacy. This literacy crisis on money-handling has long been recognized by The Filipino Times (TFT) and New Perspective Media (NPM).

Wanting to solve this knowledge gap, the Philippine Property, and Investment Exhibition or PPIE was created. For years, TFT and NPM have been gathering the top executives and financial literary experts in the Middle East and the Philippines to service Filipinos overseas by giving them access to a wide array of knowledge about where and how one can start investing.

This year, PPIE is back with more participating experts from various fields. The two whole-day event this November 5 and 6 will be held at the Crowne Plaza Hotel, Dubai. To register, visit ppie.ae

VOX POP? Why is investing your money wiser than simply saving?

The Filipino Times spoke to several OFWs who believe that putting your money in an asset will yield better results rather than having your money sit and wait in your savings account – here’s why.

Here are some more reasons why Overseas Filipinos think Investing Money is Wiser than simply Saving:

Is the peso really weak?

Source: Pinoy News Udpates PH

0 comments :

Post a Comment